| “RESOLVED, that the compensation paid to the company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”

| | | | | | MDU Resources Group, Inc. Proxy Statement | 11 |

As this is an advisory vote, the results will not be binding on the company, the board of directors, or the compensation committee and will not require us to take any action. The final decision on the compensation of our named executive officers remains with our compensation committee and our board of directors, although our board and compensation committee will consider the outcome of this vote when making future compensation decisions. As the board of directors determined at its meeting in May 2011, we will provide our stockholders with the opportunity to vote on our named executive officer compensation at every annual meeting until the next required vote on the frequency of stockholder votes on named executive officer compensation. The next required vote on frequency will occur at the 2017 annual meeting of stockholders. The board of directors recommends a vote “for” the approval, on ana non-binding advisory basis, of

the compensation of our named executive officers, as disclosed in this proxy statement. Approval of the compensation of our named executive officers requires the affirmative vote of a majority of our common stock present in person or represented by proxy at the meeting and entitled to vote on the proposal. Abstentions will count as votes against this proposal. Broker non-votes are not counted as voting power present and, therefore, are not counted in the vote. | | | | | | MDU Resources Group, Inc. Proxy Statement

| 11

|

EXECUTIVE COMPENSATION Compensation Discussion and Analysis The following compensation discussion and analysis may contain statements regarding corporate performance targets and goals. These targets and goals are disclosed in the limited context of our compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply these statements to other contexts. 2011 Named Executive Officers

For 2011, our named executive officers were Terry D. Hildestad, Doran N. Schwartz, J. Kent Wells, John G. Harp, and William E. Schneider. Mr. Hildestad is our president and chief executive officer, and Mr. Schwartz is our vice president and chief financial officer. Mr. Wells, president and chief executive officer of Fidelity Exploration & Production Company, a direct wholly-owned subsidiary of WBI Holdings, Inc., was hired in May 2011 and is a named executive officer for the first time. Mr. Harp was president and chief executive officer of MDU Construction Services Group, Inc. during 2011 and, effective January 1, 2012, became chief executive officer of Knife River Corporation as well as MDU Construction Services Group, Inc. Mr. Schneider was president and chief executive officer of Knife River Corporation during 2011 and, effective January 1, 2012, became MDU Resources Group, Inc. executive vice president of Bakken development.

Summary of Company Performance and Named Executive Officer Compensation Paid –2011– 2012 Compared to 2010 MDU Resources Group, Inc. was comprised of the following business segments in 2011:

2011

Our named executive officers for 2012 were: | | • | Terry D. Hildestad, our president and chief executive officer, who retired January 3, 2013 | | | • | Doran N. Schwartz, our vice president and chief financial officer | | | • | William E. Schneider, our executive vice president of Bakken development, a role he assumed on January 1, 2012 | | | • | J. Kent Wells, who led our exploration and production segment as president and chief executive officer of Fidelity Exploration & Production Company, a direct wholly-owned subsidiary of WBI Holdings, Inc., and | | | • | Steven L. Bietz, who led our pipeline and energy services segment as president and chief executive officer of WBI Holdings, Inc., which is the parent company of WBI Energy, Inc. and WBI Energy Services, Inc. | | | In addition to the business segments above, we have the following business segments: | | • | electric and natural gas distribution1under the leadership of David L. Goodin, who was during 2012 the president and chief executive officer of Montana-Dakota Utilities Co., Great Plains Natural Gas Co., Cascade Natural Gas Corporation, and Intermountain Gas Company, | | | •

| pipeline and energy services under the leadership of Steven L. Bietz, thewho was promoted, effective January 4, 2013, to be president and chief executive officer of WBI Holdings,MDU Resources Group, Inc., which is the parent company of WBI Pipeline & Storage Group, Inc. and WBI Energy Services, Inc.

| | | •

| exploration and production under the leadership of J. Kent Wells, the president and chief executive officer of Fidelity Exploration & Production Company, a subsidiary of WBI Holdings, Inc.

| | | •

| construction materials and contracting under the leadership of William E. Schneider, the president and chief executive officer of Knife River Corporation and

| | | • | construction services segment and construction materials and contracting segment under the leadership of John G. Harp, who is the president and chief executive officer of MDU Construction Services Group, Inc. and Knife River Corporation. |

Our consolidated financial results for 2011 and 2010 were:

| | | | | | | | Item | | 2011 Result | | 2010 Result | | Consolidated Earnings on Common Stock | | | $212.3 million | | | $240.0 million | | Earnings per Share (diluted) | | | $1.12 | | | $1.27 | | Return on Invested Capital | | | 6.3% | | | 7.0% | | Total Stockholder Return | | | 9.1% | | | (11.3)% | |

Our business segment results were as follows:

| | | •

| electric and natural gas distribution earnings increased from $65.9 million in 2010 to $67.7 million in 2011

| | | | •

| pipeline and energy services earnings decreased from $23.2 million in 2010 to $23.1 million in 2011

| | | | •

| exploration and production earnings decreased from $85.6 million in 2010 to $80.3 million in 2011

| | | | •

| construction materials and contracting earnings decreased from $29.6 million in 2010 to $26.4 million in 2011 and

| | | | •

| construction services earnings increased from $18.0 million in 2010 to $21.6 million in 2011.

| | | | | | 1 | Natural gas distribution is a separate business segment, although we are showing it combined in this discussion. |

| | | | | | 12 | MDU Resources Group, Inc. Proxy Statement |

WhileFinancial Results for 2012 and 2011 performance in our electric

Our consolidated financial results for 2012 was a loss of $1.4 million compared to 2011 earnings of $212.3 million. Adjusted earnings were $216.8 million for 2012, compared to 2011 adjusted earnings of $225.2 million. The following table compares 2012 results to 2011 results on a business segment basis. Adjusted earnings and natural gas and construction services segments was strong, performanceinformation in the pipelinetable below contain non-GAAP numbers. Please refer to the Use of Non-GAAP Financial Measures and energy services, explorationReconciliation of GAAP to Adjusted Earnings sections below.

| | | | | | | | Business Segment | | 2012 Earnings

($) (millions) | | 2011 Earnings

($) (millions) | | Electric and Natural Gas Distribution | | | 60.0 | | | 67.6 | | Pipeline and Energy Services | | | 11.6 | | | 23.1 | | Exploration and Production | | | 69.6 | | | 80.3 | | Construction Materials and Services | | | 70.8 | | | 48.0 | | Other | | | 4.8 | | | 6.2 | | | | | | | | | | Earnings Before Discontinued Operations, Noncash Write-Downs of Oil and Natural Gas Properties, and Net Benefit Related to Natural Gas Gathering Operations Litigation | | | 216.8 | | | 225.2 | | | | | | | | | | Income (Loss) from Discontinued Operations, Net of Tax* | | | 13.6 | | | (12.9 | ) | Effects of Noncash Write-Downs of Oil and Natural Gas Properties | | | (246.8 | ) | | — | | Net Benefit Related to Natural Gas Gathering Operations Litigation | | | 15.0 | | | — | | Earnings (Loss) on Common Stock | | | (1.4 | ) | | 212.3 | |

| | * | Reflects a 2012 reversal of a 2011 arbitration charge of $13.0 million after tax related to a guarantee of a construction contract |

Use of Non-GAAP Financial Measures

As noted above, the company, in addition to presenting its earnings information in conformity with Generally Accepted Accounting Principles (GAAP), has provided non-GAAP earnings data that reflects an adjustment to exclude a fourth quarter 2012 $145.9 million after-tax noncash ceiling test write-down, a third quarter 2012 $100.9 million after-tax noncash ceiling test write-down, as well as an adjustment to exclude a second quarter 2012 reversal of an arbitration charge of $15.0 million after-tax. The company believes that these non-GAAP financial measures are useful to investors because the items excluded are not indicative of the company’s continuing operating results. Also, the company’s management uses these non-GAAP financial measures as indicators for planning and production,forecasting future periods. The presentation of this additional information is not meant to be considered a substitute for financial measures prepared in accordance with GAAP. Reconciliation of GAAP to Adjusted Earnings | | | | | | | | | | | | | | | | 2012

Earnings

($) (millions) | | 2011

Earnings

($) (millions) | | 2012

Earnings

Per Share | | 2011

Earnings

Per Share | | Earnings (Loss) on Common Stock | | | (1.4 | ) | | 212.3 | | | (0.01 | ) | | 1.12 | | Discontinued Operations | | | (13.6 | ) | | 12.9 | | | (0.07 | ) | | 0.07 | | Noncash Write-Downs of Oil and Natural Gas Properties | | | 246.8 | | | — | | | 1.31 | | | — | | Net Benefit Related to Natural Gas Gathering Operations Litigation | | | (15.0 | ) | | — | | | (0.08 | ) | | — | | Adjusted Earnings | | | 216.8 | | | 225.2 | | | 1.15 | | | 1.19 | |

Total Realized Pay in 2012 and construction materials segments2011

The compensation committee believes considering total realized pay is equally as important as considering total compensation as presented in the summary compensation table. Total compensation as presented in the summary compensation table contains estimated values of grants of performance shares based on multiple assumptions that may or may not come to fruition. Also, the summary compensation table shows an increase in change in pension value and above-market earnings on nonqualified deferred compensation. The pension plan was frozen as of December 31, 2009, and none of the named executives’ benefit levels in the Supplemental Income Security Plan, our non-qualified retirement program, increased for 2012. The primary reason for increases in the change in pension value is due to a lower than in 2010. We believe thatdiscount rate used to calculate the values. Total realized pay, on the other hand, reflects the compensation actually earned, including the value of incentive awards if the goals are met and excluding the value of incentive awards if the goals are not met. Because we have not met certain performance measures in the last several years, our named executive officers for 2011 reflects these results. In termsofficers’ total realized pay excludes the value of remuneration, this overview focuses on theincentive awards that were not earned. We define total compensation paid to our named executives. Total compensation paid isrealized pay as the sum of base salary, annual incentive award paid, and the value realized upon the vesting of long-term incentive awards of performance shares, and restricted stock. While the compensation committee believes that totalall other compensation as reported in the Summary Compensation Table is important, it does not show the actual value in thesummary compensation paid to our named executive officers, which the compensation committee believes is important to show stockholders. The three major differences are that the total compensation reported in the Summary Compensation Table shows:table.

| | •

| the change in pension value, which increased in 2011 due to lower discount rates used to calculate the values. Because the defined benefit pension plans were frozen as of January 1, 2010, and none of our named executives received benefit level increases in our Supplemental Income Security Plan for 2011, their retirement benefits under these programs did not increase.

| | | •MDU Resources Group, Inc.Proxy Statement

| a grant date fair value assigned to performance share awards, which are potential payments based on multiple assumptions. Performance shares are paid, if at all, three years after grant, based upon our total stockholder return in comparison to our peer group and13

|

| | •Proxy Statement

| all other compensation for the named executives officers, which we excluded from total compensation paid because the dollar amount did not change from 2010 to 2011, except for a very small amount for Mr. Harp.

|

The following table compares total compensation paidrealized pay for our named executives in 2012 to Messrs. Hildestad, Schwartz, Harp, and Schneider, the four 2011 named executive officers who were also employed by the company in 2010. Three of the four named executive officer’s total compensation paid decreased in 2011 and, as a group, their total compensation paid decreased $821,353, or 17.3% when compared to 2010.2011. Total Compensation Paid in 2011 and 2010

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Named

Executive

Officer | | Year | | Base Salary

($) | | Annual

Incentive

Awards

Paid

($) | | Value

Realized

upon

Vesting of

Performance

Shares

($) | | Value

Realized

upon

Vesting of

Restricted

Stock

($)(3) | | Total

Compensation

Paid

($)(4) | | | Year | | Base Salary

($) | | Annual

Incentive

Awards

and

Bonus

Paid

($) | | Value

Realized

upon

Vesting of

Performance

Shares

($) | | All

Other

Compensation

($) | | Total

Realized

Pay

($) | | Terry D. Hildestad | | 2011 | | 750,000 | | 954,750 | | 0 | (1) | | — | | 1,704,750 | | | 2012 | | 750,000 | | 518,250 | | 0(1) | | | 38,224 | | 1,306,474 | | | | 2010 | | 750,000 | | 762,750 | | 720,474 | (2) | | 73,498 | | 2,306,722 | | | 2011 | | 750,000 | | 954,750 | | 0(2) | | | 37,499 | | 1,742,249 | | Doran N. Schwartz | | 2011 | | 273,000 | | 173,765 | | 0 | (1) | | — | | 446,765 | | | 2012 | | 300,000 | | 103,650 | | 0(1) | | | 34,224 | | 437,874 | | | �� | | 2010 | | 252,454 | | 127,053 | | 75,398 | (2) | | — | | 454,905 | | | 2011 | | 273,000 | | 173,765 | | 0(2) | | | 33,549 | | 480,314 | | John G. Harp | | 2011 | | 450,000 | | 438,750 | | 0 | (1) | | — | | 888,750 | | | Steven L. Bietz | | | 2012 | | 360,500 | | 347,973 | | 0(1) | | | 37,884 | | 746,357 | | | | | 2011 | | 360,500 | | 229,198 | | 0(2) | | | 37,159 | | 626,857 | | J. Kent Wells | | | 2012 | | 550,000 | | 934,042 | (3) | | N/A | | | 96,470 | | 1,580,512 | | | | 2010 | | 450,000 | | 438,750 | | 221,666 | (2) | | — | | 1,110,416 | | | 2011 | | 367,671 | | 1,923,991 | (4) | | N/A | | | 84,580 | | 2,376,242 | | William E. Schneider | | 2011 | | 447,400 | | 436,215 | | 0 | (1) | | — | | 883,615 | | | 2012 | | 447,400 | | 200,950 | | 0(1) | | | 38,224 | | 686,574 | | | | 2010 | | 447,400 | | 37,805 | | 329,179 | (2) | | 58,806 | | 873,190 | | | 2011 | | 447,400 | | 436,215 | | 0(2) | | 37,499 | | 921,114 | | | | | | | 2011 Total | | 3,923,880 | | | | | | | | 2010 Total | | 4,745,233 | | |

| | (1) | Performance shares and dividend equivalents granted for the 2009-2011 performance period that did not vest and were forfeited because performance was below threshold. | (2) | Performance shares and dividend equivalents granted for the 2008-2010 performance period that did not vest and were forfeited because performance was below threshold. | (2)(3)

| PerformanceReflects the value of the portion of Mr. Wells’ additional 2011 annual incentive award that was paid in shares paid for the 2007-2009 performance period. The value realized isof our common stock based on our closing stock price of $19.99 on February 11, 2010, and includes the dividend equivalents paid$21.67 on the vested shares.

| (3)

| Reflects the value of restricted shares granted in 2001 that vested automatically and were paid onvesting date, February 15, 2010, based on our closing stock price of $19.80 on February 12, 2010, as February 15, 2010, was a holiday.16, 2012.

| (4) | Total compensation paid is the sumMr. Wells was hired as president and chief executive officer of base salary,Fidelity Exploration & Production Company effective May 2, 2011. Includes a cash recruitment payment of $550,000, annual incentive award paid,payment of $448,981, and the value realized upon vestingadditional annual incentive payment of long-term incentive awards of performance shares and restricted stock.$925,010.

|

TheOur named executive officers forfeited all performance shares and dividend equivalents for the 2009-2011 performance period because our total stockholder return in comparison to our peer group was at the 25th percentile. With respect to the annual incentive awards, our 2012 results in the construction services segment, construction materials and contracting segment, and the pipeline and energy services segment were above their performance targets, and, conversely, 2012 results for the exploration and production segment and the electric and gas distribution segments were below their threshold performance goals, with 2012 consolidated earnings per share results also below threshold. Since the corporate named executives’ annual incentives depend on achievement of the foregoing performance goals, Messrs. Hildestad’s, Schwartz’s, and Schneider’s 2012 annual incentives were paid below the target amount.

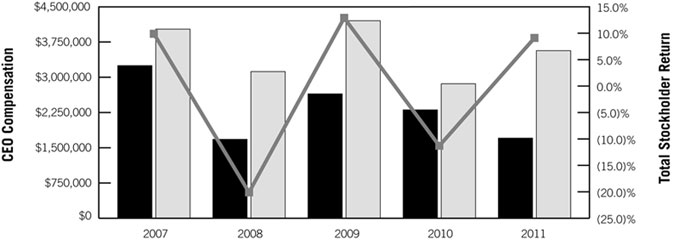

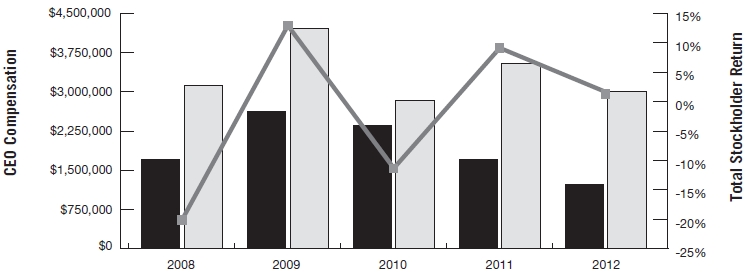

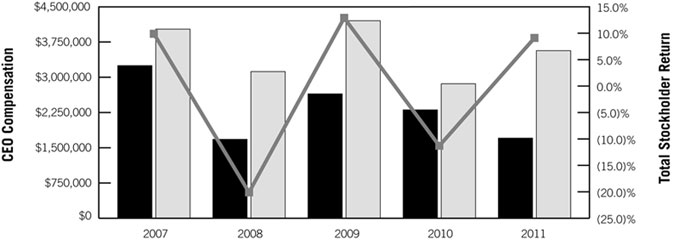

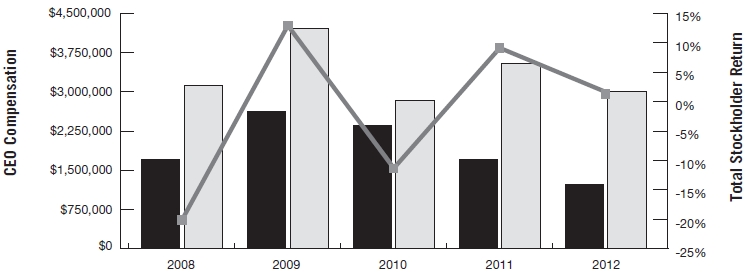

With respect to our chief executive officer, the following table further demonstrates our pay for performance policy specifically for our chief executive officerapproach by comparing: | | | • | his total compensation paid,realized pay, which is the sum of base salary, annual incentive awards paid, all other compensation, and the value realized upon the | | | | | o | vesting of restricted stock during 2010 | | | | | o | vesting of performance shares during 2007, 2008, 2009, and 2010 (none vested in 2011) and | | | | | o

| exercise of stock options in 20072011 or 2012)

| | | | • | his total compensation as reported in the summary compensation table and | | | | • | one-year total stockholder returns for 2007 to 2011.2008 through 2012. |

| | | | 14 | MDU Resources Group, Inc.Proxy Statement | 13

|

5 Year CEO Compensation and Total Stockholder Return

| | | | | | | | | | | | | | | | | | | | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | |

| Total Compensation Paid | | | $3,248,707 | | | $1,680,323 | | | $2,647,426 | | | $2,306,722 | | | $1,704,750 | |

| Total Compensation

from Summary

Compensation Table | | | $4,023,732 | | | $3,119,702 | | | $4,203,004 | | | $2,860,918 | | | $3,566,327 | |

| 1 Year TSR | | | 9.9% | | | (20.1)% | | | 12.9% | | | (11.3)% | | | 9.1% | | | | | | | | | | | | | | | | | | | | Total Compensation Paid = Base Salary + Annual Bonus Paid + Performance Shares that Vested + Restricted Stock that Vested + 2007 Stock Option Exercise |

| | | | | | | | | | | | | | | | | | | | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | |

| Total Realized Pay | | | $1,689,799 | | | $2,657,250 | | | $2,344,221 | | | $1,742,249 | | | $1,306,474 | |

| Total Compensation

from Summary

Compensation Table | | | $3,119,702 | | | $4,203,004 | | | $2,860,918 | | | $3,566,327 | | | $2,558,778 | |

| 1 Year Total

Stockholder Return | | | -20.1% | | | 12.9% | | | -11.3% | | | 9.1% | | | 2.1% | |

Comparing Mr. Hildestad’sThe yearly changes in total compensation paid and total compensation as reported infrom the summary compensation table against annualand total realized pay align very closely with the yearly changes in total stockholder return shows:return.

Overview of 2012 Compensation for our Named Executive Officers

In 2012, we continued our approach of referencing market data to establish competitive pay levels for base salary, total annual cash, which is base salary plus target annual incentive, and total direct compensation, which is the sum of total annual cash plus the expected value of target long-term incentives. We discuss this competitive assessment in the Role of Management section below. To ensure compensation awarded to named executive officers was commensurate with competitive performance levels, we continued to compare: | | • | In 2007, annual total stockholder return was 9.9%results to the results of our performance graph peer group to determine payouts under our performance share program and Mr. Hildestad’s total compensation paid increased by 65% and his total compensation as reported in the summary compensation table increased by 30%.

| | | • | In 2008, annual total stockholderon a historical basis, our targeted and actual results on return was (20.1)% and Mr. Hildestad’s total compensation paid decreased by 48% and his total compensation as reported inon invested capital to the summary compensation table decreased by 23%.

| | | •

| In 2009, annual total stockholder return was 12.9% and Mr. Hildestad’s total compensation paid increased by 58% and his total compensation as reported in the summary compensation table increased by 35%.

| | | •

| In 2010, annual total stockholder return was (11.3)% and Mr. Hildestad’s total compensation paid decreased by 13% and his total compensation as reported in the summary compensation table decreased by 32%.

| | | •

| In 2011, annual total stockholder return was 9.1% and Mr. Hildestad’s total compensation paid decreased by 26% and his total compensation as reported in the summary compensation table increased by 25%.

|

| Overview of 2011 Compensation for our Named Executive Officers

| Our 2011 compensation program for our named executive officers was designed to link their compensation to our financial performance and align their interests with thoseresults of our stockholders. Mr. Wells’performance graph peer group when the compensation wascommittee established to induce him to join the company while, at the same time, basing his incentive payments on the attainment of financial results. We discuss Mr. Wells’ compensation in a separate section below, and the following discussionperformance targets for annual incentives of our named executive officers’ compensation excludes Mr. Wells.business segment leaders.

| | Our overall compensation program and philosophy is built on a foundation of these guiding principles: |

| | • | we pay for performance, with 55.6% to 71.4%76.5% of our named executive officers’ 20112012 total target direct compensation in the form of incentives | | | • | we determine annual performance incentives based on financial criteria that are important to stockholder value, –including earnings per share and return on invested capital and | | | • | we determine long-term performance incentives based on total stockholder return relative to our peersperformance graph peer group | | | • | we review competitive compensation data for eachour named executive officerofficers, to the extent available, and incorporate internal equity in the final determination of target compensation levels and | | | • | through our PEER Analysis, we compare our pay-for-performance results with the pay-for-performance results ofon key financial metrics – revenue, profit, return on invested capital, and stockholder return – in comparison to our peers over five-year periods.performance graph peer group. |

| | | | 14

| MDU Resources Group, Inc.Proxy Statement

|

The compensation committee took the following actions with respect to 2011 compensation for our named executive officers:

| | •

| froze 2011 base salaries at their 2009 and 2010 levelsThe compensation committee took the following actions with respect to 2012 compensation for Messrs. Hildestad, Harp, and Schneider and provided a 5% salary increase only to Mr. Schwartzour named executive officers:

| | | • | maintainedgranted a salary increase to Mr. Hildestad to recognize his effective leadership during an extended period of economic softness. Mr. Hildestad subsequently rejected the same percentagessalary increase because he felt accepting the increase would be out of place since five of the thirteen Section 16 officers did not receive an increase for 2012

| | | • | granted a salary increase to Mr. Schwartz to bring his salary closer to his salary grade midpoint |

| | | | MDU Resources Group, Inc. Proxy Statement | 15 |

| | • | tied 25% of our business segment leaders’ 2012 annual incentive targets to the company’s 2012 earnings per share results in order to more closely align amounts paid to these executives with total company results | | | • | increased Mr. Wells’ annual incentive target from 100% to 125% of base salary used to establish target incentive awardsmitigate the impact of the added company earnings per share goal and to reflect his impact on overall company results | | | • | continued to link our corporate executives’ – i.e., Messrs. Hildestad, Schwartz, and SchwartzSchneider – 20112012 annual incentive awards to the achievement of our business units’segments’ performance goals | | | • | maintained the limitation on the maximum payment with respect to the return on invested capital portion of the 2011 annual incentive awards at MDU Construction Services Group, Inc., Knife River Corporation, Fidelity Exploration & Production Company, and WBI Holdings, Inc. at 100% of the target incentive award, unless return on invested capital equaled or exceeded the business unit’s weighted average cost of capital

| | | •

| provided for mandatory reductions in any performance shares earned pursuant to awards granted in 2011 if our total stockholder return for the 2011-2013 performance period is negative

| | | •

| in 2011 the compensation committee did not approve payment of any performance shares or dividend equivalents granted in 20082009 for the 2008-20102009-2011 performance period due to our negative total stockholder return for the 2008-20102009-2011 performance period placing us in the 33rd25th percentile compared to our performance graph peer group

| | | •

| imposed mandatory stock holding requirements on a portion of shares earned pursuant to long-term incentive awards granted in 2011 or thereafter and

| | | • | granted no increases under our SISP,Supplemental Income Security Plan, which is a nonqualified retirement plan that provides benefits to our key managers and four of our named executive officers. |

| J. Kent Wells

| We hired Mr. Wells as the president and chief executive officer of Fidelity Exploration & Production Company, effective May 2, 2011. Mr. Hildestad, with assistance from our vice president-human resources, negotiated Mr. Wells’ compensation in connection with his hiring; his compensation is set forth in a letter agreement, which was approved by the compensation committee and the board of directors at their regular February 2011 meetings. The compensation committee approved Mr. Wells’ compensation after considering his extensive experience in leading the oil and gas industry and his demonstrated track record of substantially increasing reserves and production while reducing finding costs.

| | Mr. Wells’ letter agreement provides for the following:

|

| | | •

| a base salary of $550,000, prorated for his eight months of employment during 2011. We discuss how Mr. Wells’ base salary was determined in the Base Salaries of the Named Executive Officers for 2011 section below.

| | | | •

| a cash recruitment payment of $550,000 to induce Mr. Wells to join the company and to offset the forfeiture of restricted stock granted by his former employer that would otherwise have vested in 2012 and 2013

| | | | •

| a target annual incentive award opportunity of 100% of base salary prorated to reflect his eight months of employment during 2011. Mr. Wells would receive a guaranteed minimum payment equal to the 2011 prorated target amount and could earn up to 200% of target if:

| | | | | o

| Fidelity Exploration & Production Company and WBI Holdings, Inc.’s 2011 earnings per share were at or above 115% of the performance targets approved by the compensation committee

| | | | | o

| Fidelity Exploration & Production Company and WBI Holdings, Inc.’s 2011 returns on invested capital were both at least equal to their respective weighted average costs of capital

| | | | | o

| Fidelity Exploration & Production Company achieved its production goal and

| | | | | o

| WBI Holdings, Inc. achieved its five safety goals.

| | | | | We discuss this incentive award in the 2011 Annual Incentives section below.

| | | | •

| to offset other compensation Mr. Wells would have received if he had stayed with his former employer, an additional 2011 incentive award opportunity to earn $1.85 million, payable one-half in cash and one-half in our common stock, if Fidelity Exploration & Production Company’s 2011 cash flow from operations exceeded $132.0 million. We discuss this incentive award in the 2011 Annual Incentives section below.

| | | | •

| commencing in 2012, a target long-term incentive opportunity of 200% of base salary and

| | | | •

| relocation benefits consisting of:

| | | | | o

| reasonable expenses for two home finding trips for Mr. Wells and his spouse

| | | | | o

| monthly reimbursements of up to $3,000 for 6 months for temporary living expenses

|

| | | | MDU Resources Group, Inc.Proxy Statement

| 15

|

| | | | | o

| reasonable expenses incurred during the actual move from the Houston area to Denver

| | | | | | o

| reimbursementIn addition, our Section 16 officers who had change of actual and reasonable costs of moving household goods and personal effects

| | | | | | o

| a relocation allowance equal to one month’s salary

| | | | | | o

| reimbursement of the following home sale expenses:

| | | | | | | •

| reasonable attorney’s fees

| | | | | | | •

| federal, state and local transfer taxes

| | | | | | | •

| search fees and title insurance

| | | | | | | •

| brokerage commission of a licensed real estate broker

| | | | | | | •

| mortgage prepayment penalties

| | | | | | | •

| recording fees

| | | | | | | •

| any other fees or expenses approved in advance in writing by the company

| | | | | | o

| a bonus of 3% of the sales price of Mr. Wells’ Houston area home up to a maximum of $15,000

| | | | | | o

| reimbursement of the following costs to acquire a new home if Mr. Wells purchases a new home within 18 months from his hire date:

| | | | | | | •

| title search and title insurance

| | | | | | | •

| mortgage service charges and mortgage taxes

| | | | | | | •

| bank applications and processing and appraisal fees

| | | | | | | •

| recording and notary fees

| | | | | | | •

| state and local transfer taxes

| | | | | | | •

| termite inspection

| | | | | | | •

| land survey

| | | | | | | •

| attorney’s fees up to a maximum of 1% of the new mortgage amount

| | | | | | | •

| origination fees or points up to a maximum of 2% of the new mortgage amount and

| | | | | | | •

| any other fees or expenses approved in writing by the company and

| | | | | | o

| spousal career assistance.

| | | | | Mr. Wells received $66,031 in relocation benefits for 2011 consisting of $18,000 in temporary living expenses, $2,198 in actual move and related expenses, and $45,833 in relocation allowance. We anticipate Mr. Wells completing his relocationcontrol employment agreements agreed to the Denver area duringearly termination of their agreements, effective November 1, 2012.

| | | | | Mr. Wells must repay the relocation benefits he received if he resigns from the company within one year from when his household goods and personal effects are moved to the Denver area.

| | | | | Objectives of our Compensation Program | We structure our compensation program to help retain and reward the executive officers who we believe are critical to our long-term success. We have a written executive compensation policy for our Section 16 officers, including all our named executive officers. Our policy has the followingpolicy’s stated objectives:objectives are to: | | | | | • | recruit, motivate, reward, and retain the high performing executive talent required to create superior long-term total stockholder return in comparison to our peer group | | | | | • | reward executives for short-term performance, as well as the growth in enterprise value over the long-term | | | | | • | provide a competitive package relative to industry-specific and general industry comparisons and internal equity, as appropriate | | | | | • | ensure effective utilization and development of talent by working in concert with other management processes – for example, performance appraisal, succession planning, and management development and | | | | | • | help ensure that compensation programs do not encourage or reward excessive or imprudent risk taking. |

| | | | 16

| MDU Resources Group, Inc.Proxy Statement

|

| Elements of our Compensation Program | We pay/grant: | | | • | base salaries in order to provide executive officers with sufficient, regularly-paid income and attract, recruit, and retain executives with the knowledge, skills, and abilities necessary to successfully execute their job duties and responsibilities | | | • | opportunities to earn annual incentive compensation in order to be competitive from a total remuneration standpoint and ensure focus on annual financial and operating results and | | | • | opportunities to earn long-term incentive compensation in order to be competitive from a total remuneration standpoint and ensure focus on stockholder return. | | | If earned, incentive compensation, which consists of annual cash incentive awards and three-year performance share awards under our Long-Term Performance-Based Incentive Plan, makes up the greatest portion of our named executive officers’ total compensation. The compensation committee believes incentive compensation that comprised approximately 55.6% to 71.4%76.5% of total target compensation for the named executive officers except for Mr. Wells, for 2011 is appropriate because: | | | • | our named executive officers are in positions to drive, and therefore bear high levels of responsibility for, our corporate performance | | | • | incentive compensation is more variable than base salary and dependent upon our performance | | | • | variable compensation helps ensure focus on the goals that are aligned with our overall strategy and | | | • | the interests of our named executive officers will be aligned with those of our stockholders by making a majority of the named executive officers’ target compensation contingent upon results that are beneficial to stockholders. |

| | | | | | 16 | MDU Resources Group, Inc. Proxy Statement |

The following table shows the allocation of total target compensation for 20112012 among the individual components of base salary, annual incentive, and long-term incentive: | | | | | | | | | | | | | | | | | | | | | | | | | | | | % of Total

Target

Compensation

Allocated to

Base Salary (%) | | % of Total Target Compensation

Allocated to Incentives | | | | | | | | | | | | | | | | | | Annual +

Long-Term (%) | | | | Name | | | % of Total

Target

Compensation

Allocated to

Base Salary (%) | | % of Total Target Compensation

Allocated to Incentives | | | | | | | % of Total

Target

Compensation

Allocated to

Base Salary (%) | | Annual (%) | | Long-Term (%) | | Annual +

Long-Term (%) | | Annual (%) | | Long-Term (%) | | Annual +

Long-Term(%) | | Terry D. Hildestad | | 28.6 | | 42.8 | | | 28.6 | | 28.6 | | 42.8 | | 71.4 | | Doran N. Schwartz | | 22.2 | | 33.4 | | 55.6 | | | 44.4 | | 22.2 | | 33.4 | | 55.6 | | | Steven L. Bietz | | | 39.2 | | 25.5 | | 35.3 | | 60.8 | | J. Kent Wells (1) | | 81.4 | | 0.0 | | 81.4 | | | 23.5 | | 29.4 | | 47.1 | | 76.5 | | John G. Harp | | 39.2 | | 25.5 | | 35.3 | | 60.8 | | | William E. Schneider | | 39.2 | | 25.5 | | 35.3 | | 60.8 | | | 39.2 | | 25.5 | | 35.3 | | 60.8 | | (1) Mr. Wells received two annual incentive awards in 2011, but no long-term incentive award in 2011. | | |

In order to reward long-term growth, as well as short-term results, the compensation committee establishes incentive targets that emphasize long-term compensation as much as or more than short-term compensation for our named executive officers. Except for Mr. Wells, the annual incentive targets for 2011 range from 50% to 100% of base salary and the long-term incentive targets range from 75% to 150% of base salary, depending on the named executive officer’s salary grade. In Mr. Wells’ case for 2011, his incentives are made up of a target annual incentive opportunity of 100% of base salary plus an additional incentive opportunity of $1.85 million. After 2011 and pursuant to his letter agreement, Mr. Wells’ target annual incentive opportunity will remain at 100% of base salary and his long-term incentive target will be 200% of base salary. Generally, our approach is to allocategenerally allocates a higher percentage of total target compensation to the long-term incentive than to the short-term incentive for our higher level executives, since they are in a better position to influence our long-term performance. Additionally, the long-term incentive, if earned, is paid in company common stock. These awards, combined with our stock retention requirements and stock ownership policy, promote ownership of our stock by the named executive officers. The compensation committee believes that, as stockholders, the named executive officers will be motivated to consistently deliver financial results that build wealth for all stockholders over the long-term. | Role of Compensation ConsultantsManagement | Our executive compensation policy providescalls for an assessment of the competitive pay levels for base salary and incentive compensation for each Section 16 officer position to be conducted at least every two years by an independent consulting firm. InTowers Watson conducted the study in 2010 for purposes of 2011 compensation,use by the compensation committee retained Towers Watson, a nationally recognized consulting firm, to perform this assessment and to assistdetermine 2011 compensation levels. In 2011, the compensation committee requested the competitive assessment be completed internally. They directed the vice president-human resources and the human resources department to prepare the competitive assessment in August 2011 on Section 16 officers for their use in establishing competitive compensation targets for our Section 16 officers. |

| | | | MDU Resources Group, Inc.Proxy Statement

| 17

|

| Proxy Statement

| 2012 compensation. |

The assessment included identifying any material changes to the positions analyzed, and their scopes of responsibility, summarizing current incumbent compensation information, updating competitive compensation information, gathering and analyzing relevant general and industry-specific survey data, validating position matches and survey data with our management, assessing pay relationships for our chief executive officer as compared to our chief financial officer and the business unit presidents and chief executive officers, and updating the base salary structure. Towers WatsonThe human resources department assessed competitive pay levels for base salary, total annual cash, which is base salary plus target annual incentives, and total direct compensation, which is the sum of total annual cash and the expected value of target long-term incentives. TheyThe competitive assessment compared our positions to like positions contained in general industry compensation surveys and industry-specific compensation surveys and, for our chief executive officer, tosurveys. The human resources department aged the chief executive officers in our performance graph peer group. Towers Watson also aged thesurvey data from the date of the surveyssurvey by 2.5% on an annualized basis to estimate 2011the 2012 competitive targets. The compensation surveys and databases used by Towers Watson were:are listed on the following table: | | | | | | | | | | Survey* | | Number of

Companies

Participating

(#) | | Median

Number of

Employees

(#)(1) | | Publicly-

Traded

Companies

(#) | | Number of

Median

Revenue

(000s)

($) | | Towers Perrin 2009 Compensation Databank General Industry Executive Database | | 428 | | 19,083 | | 310 | | 6,199,000 | | Towers Perrin 2009 Compensation Databank Energy Services Executive Database | | 98 | | 3,290 | | 62 | | 3,371,000 | | 2009 Effective Compensation, Inc. Oil & Gas Exploration Compensation Survey | | 119 | | 451 | | 49 | | Not reported | | Mercer’s 2009 Total Compensation Survey for the Energy Sector | | 276 | | Not reported | | 205 | | 1,057,000 | | Watson Wyatt 2009/2010 Report on Top Management Compensation | | 2,275 | | — | (2) | — | (2) | — | (2) |

| | | | | | | | | | | | | | Survey* | | Number of

Companies

Participating

(#) | | Median

Number of

Employees

(#)(1) | | Number of

Publicly-

Traded

Companies

(#) | | Median

Revenue

(000s)

($) | | Towers Watson 2010 General Industry Executive Database | | | 430 | | | 16,400 | | | 312 | | | 5,112,000 | | Towers Watson 2010 U.S. CDB Energy Services Executive Database | | | 102 | | | 3,012 | | | 67 | | | 2,818,000 | | 2010 Effective Compensation, Inc. Oil & Gas Exploration Compensation Survey | | | 121 | | | 439 | | | 48 | | | Not Reported | | Mercer’s 2010 Total Compensation Survey for the Energy Sector | | | 297 | | | Not Reported | | | 201 | | | 823,000 | | Towers Watson 2010/2011 Report on Top Management Compensation | | | 3,422 | | | — | (2) | | — | (2) | | — | (2) |

| | | (1) | For the 20092010 Effective Compensation, Inc. Oil & Gas Exploration Compensation Survey, the number reported as the Median Number of Employees is the average number of employees. | (2) | The 2,2753,422 organizations participating in Watson Wyatt’s 2009/2010Towers Watson’s 2010/2011 Top Management Compensation Survey included 350394 organizations with 2,000 to 4,999 employees; 327308 organizations with 5,000 to 9,999 employees; 264205 organizations with 10,000 to 19,999 employees; and 33087 organizations with 20,000 or more employees. Towers Watson Wyatt did not provide a revenue breakdown or the number of publicly-traded companies participating in its survey. | * | The information in the table is based solely upon information provided by the publishers of the surveys and is not deemed filed or a part of this compensation discussion and analysis for certification purposes. For a list of companies that participated in the compensation surveys and databases, see Exhibit A. | | |

In billions of dollars our revenues for 2009, 2010, 2011, and 20112012 were approximately $4.2, $3.9, $4.0, and $4.0,$4.1, respectively. Since there were no specific data sources dedicated to the construction services or construction material industries, Towers Watson considered data from a subset of companies in the Towers Perrin 2009 Compensation Databank General Industry Executive Database and five public companies. The companies from the general industry survey, along with key financial data, were:

| | | | | | | | Company Name* | | Market Capitalization

Fiscal Year-End

($) (millions) | | Revenue

($) (millions) | | Total Assets

($) (millions) | | Hovnanian Enterprises | | 302.8 | | 1,596.3 | | 2,024.6 | | KB Home | | 1,193.4 | | 1,824.9 | | 3,436.0 | | Owens Corning | | 3,276.1 | | 4,803.0 | | 7,167.0 | | PulteGroup | | 3,822.7 | | 4,084.4 | | 10,051.2 | | Carpenter Technology | | 916.2 | | 1,362.3 | | 1,497.4 | | Century Aluminum | | 1,498.2 | | 899.3 | | 1,861.8 | | Crown Holdings | | 4,129.5 | | 7,938.0 | | 6,532.0 | | Kennametal | | 1,559.2 | | 1,999.9 | | 2,347.0 | | Martin Marietta Materials | | 4,052.6 | | 1,702.6 | | 3,239.3 | | Newmont Mining | | 23,338.6 | | 7,705.0 | | 22,299.0 | | Vulcan Materials | | 6,654.0 | | 2,690.5 | | 8,533.0 | |

| | *

| The information in the table is based solely upon information provided by the publisher of the general industry survey and is not deemed filed or a part of this compensation discussion and analysis for certification purposes.

|

| | | | | | 18

| MDU Resources Group, Inc. Proxy Statement

|

The five public companies Towers Watson referenced, along with key financial data, were:

| | | | | | | | | | | Company Name* | | Market Capitalization

Fiscal Year-End

($) (millions) | | Revenue

($) (millions) | | Total Assets

($) (millions) | | Dycom Industries | | | 496.5 | | | 1,106.9 | | | 693.5 | | Quanta Services | | | 4,363.8 | | | 3,318.1 | | | 4,117.0 | | EMCOR Group | | | 1,781.1 | | | 5,547.9 | | | 2,981.9 | | U.S. Concrete | | | 34.1 | | | 534.5 | | | 389.2 | | Granite Construction | | | 1,300.3 | | | 1,963.5 | | | 1,709.6 | |

| | | | *

| The information in the table is based solely upon information provided by Towers Watson and is not deemed filed or a part of this compensation discussion and analysis for certification purposes.

|

Revenues for 2009, 2010, and 2011 were approximately $819.0 million, $789.1 million and $854.0 million, respectively, for our construction services segment and were approximately $1.5 billion each year for our construction materials segment.

| Role of Management

| To verify the comparability of Mr. Hildestad’s target long-term incentive compensation and his Supplemental Income Security Plan benefits, the compensation committee directed the human resources department to prepare a report comparing the combined value of long-term incentive compensation and nonqualified defined benefit plan benefits of other chief executive officers. The report was prepared by compiling data from Equilar, Inc. and presented at the compensation committee’s November 2010 meeting. The report compared Mr. Hildestad’s target long-term incentive compensation and the Supplemental Income Security Plan benefits to those of the chief executive officers in our performance graph peer group as of February 2010 and companies with revenues ranging from $2.5 billion to $6.5 billion in the construction, energy, and utility industries. We discuss the results of this review in the 2011 Long-Term Incentives section below.

|

The following companies were in our performance graph peer group as presented at the November 2010 compensation committee meeting:

| | | | •

| Alliant Energy Corporation

| •

| OGE Energy Corp.

| •

| Berry Petroleum Company

| •

| ONEOK, Inc.

| •

| Black Hills Corporation

| •

| Quanta Services, Inc.

| •

| Comstock Resources, Inc.

| •

| Questar Corporation

| •

| Dycom Industries, Inc.

| •

| SCANA Corporation

| •

| EMCOR Group, Inc.

| •

| Southwest Gas Corporation

| •

| Encore Acquisition Company

| •

| St. Mary Land & Exploration Company

| •

| EQT Corporation

| •

| Swift Energy Company

| •

| Granite Construction Inc.

| •

| U.S. Concrete, Inc.

| •

| Martin Marietta Materials, Inc.

| •

| Vectren Corporation

| •

| National Fuel Gas Co.

| •

| Vulcan Materials Company

| •

| Northwest Natural Gas Company

| •

| Whiting Petroleum Corporation

| •

| NSTAR

| | |

The other companies reviewed for this assessment are listed in Exhibit B.

At the request of Mr. Hildestad, the human resources department conducted a competitive assessment in January 2011 to determine the compensation level necessary to recruit a qualified individual to lead Fidelity Exploration & Production Company. Mr. Hildestad, with the assistance of our vice president–human resources, negotiated Mr. Wells’ compensation in connection with his hiring. The January 2011 competitive assessment is discussed in the Base Salaries of the Named Executive Officers for 2011 section below.

The chief executive officer played an important role in recommending 2011 compensation to the committee for the other named executive officers. The chief executive officer assessed the performance of the named executive officers and reviewed the relative value of the named executive officers’ positions and their salary grade classifications. He then reviewed the competitive assessment prepared by Towers Watson and worked with the compensation consultants and the human resources department to prepare 2011 compensation recommendations for the compensation committee, other than for himself. The chief executive officer attended compensation committee meetings; however, he was not present during discussions regarding his compensation.

| | | | | | MDU Resources Group, Inc. Proxy Statement | 1917

|

The human resources department also augmented the competitive analysis by using Equilar to provide information on what was reported by companies in our performance graph peer group and by other public companies in relevant industries, as selected by the human resources department and as determined by SIC codes and as disclosed in their SEC filings. The companies referenced via Equilar and the positions for which they were used are found in Exhibit B. For our president and chief executive officer, the Equilar companies included all companies in our performance graph peer group and data on 68 additional chief executive officers from public companies in the energy, construction, and utility industries with revenues ranging from $1 billion to $8 billion. For our vice president and chief financial officer, the Equilar companies included all companies in our performance graph peer group and data on 55 additional chief financial officers from public companies in the energy, construction, and utility industries with revenues ranging from $1 billion to $8 billion. For the president and chief executive officer of our exploration and production segment, the Equilar companies included the exploration and production companies in our performance graph peer group and data on 27 additional chief executive officers from public companies in the oil and gas exploration and production industries with revenues ranging from $250 million to $850 million. For the president and chief executive officer of the pipeline and energy services segment, the Equilar companies included the pipeline and energy services companies in our performance graph peer group and data on 13 chief executive officers from public companies in the pipeline and energy services industry with revenues of $1 billion or less. The chief executive officer played an important role in recommending 2012 compensation to the committee for the other named executive officers. The chief executive officer assessed the performance of the named executive officers and considered the relative value of the named executive officers’ positions and their salary grade classifications. He then reviewed the competitive assessment prepared by the human resources department to formulate 2012 compensation recommendations for the compensation committee, other than for himself. The chief executive officer attended compensation committee meetings; however, he was not present during discussions regarding his compensation. | Timing of Compensation Decisions for 20112012 | The compensation committee, in conjunction with the board of directors, determined all compensation for each named executive officer for 20112012 and set overall and individual compensation targets for the three components of compensation – base salary, annual incentive, and long-term incentive. The compensation committee made recommendations to the board of directors regarding compensation of all Section 16 officers, and the board of directors then approved the recommendations. |

The compensation committee reviewed the competitive assessment and established 20112012 salary grades at its August 20102011 meeting. At the November 20102011 meeting, it established individual base salaries, target annual incentive award levels, and target long-term incentive award levels for 2011.2012. At their February 2011and March 2012 meetings, the compensation committee and the board of directors increased the target annual incentive award level for Mr. Wells and determined annual and long-term incentive awards, along with the payouts based on performance from the recently completed performance period for prior annual and long-term awards. The February 2011and March 2012 meetings occurred after the release of earnings for the prior year. Our stockholders had their first advisory vote on our named executive officers’ compensation at the 2011 Annual Meeting of Stockholders, and approximately 94% of the shares present in person or represented by proxy and entitled to vote on the matter approved the named executive officers’ compensation. The compensation committee and the board of directors considered the results of the vote at their November 2011 meetings and did not change our executive compensation program as a result of the vote.

| Salary Grades for 2011Stockholder Advisory Vote (“Say on Pay”)

| Our stockholders had their second advisory vote on our named executive officers’ compensation at the 2012 Annual Meeting of Stockholders. Approximately 92% of the shares present in person or represented by proxy and entitled to vote on the matter approved the named executive officers’ compensation. The 92% approval is consistent with the results of our say on pay vote at the 2011 Annual Meeting. The compensation committee and the board of directors considered the results of the votes at their November 2011 and November 2012 meetings and did not change our executive compensation program as a result of the votes. | | Salary Grades for 2012 | The compensation committee determines the named executive officers’ base salaries and annual and long-term incentive targets by reference to salary grades. Each salary grade has a minimum, midpoint, and maximum annual salary level with the midpoint targeted at approximately the 50th percentile of the competitive assessment data for positions in the salary grade. The compensation committee may adjust the salary grades away from the 50th percentile in order to balance the external market data with internal equity. The salary grades also have annual and long-term incentive target levels, which are expressed as a percentage of the individual’s actual base salary. We generally place named executive officers into a salary grade based on historical classification of their positions; however, the compensation committee reviews each classification and may place a position into a different salary grade if it determines that the targeted competitive compensation for the position changes significantly or the executive’s responsibilities and/or performance warrants a different salary grade. The committee also considers, upon recommendation from the chief executive officer, a position’s relative value. |

Our named executive officers’ salary grade classifications are listed below along with the 2011 base salary ranges associated with each classification:

| | | | | | | | | | | | | | | | | | 2011 Base Salary (000s) | | Position | | Grade | | Name | | Minimum

($) | | Midpoint

($) | | Maximum

($) | | President and CEO | | K | | Terry D. Hildestad | | 620 | | 775 | | 930 | | Vice President and CFO | | I | | Doran N. Schwartz | | 260 | | 325 | | 390 | | President and CEO, Fidelity Exploration & Production Company | | J | | J. Kent Wells | | 312 | | 390 | | 468 | | President and CEO, MDU Construction Services Group, Inc. | | J | | John G. Harp | | 312 | | 390 | | 468 | | President and CEO, Knife River Corporation | | J | | William E. Schneider | | 312 | | 390 | | 468 | |

The presidents and chief executive officers of MDU Construction Services Group, Inc. and Knife River Corporation were assigned to salary grade “J” and were unchanged for 2011. In connection with his hiring, the president and chief executive officer of Fidelity Exploration & Production Company was assigned to salary grade “J” in recognition of the importance of this business segment to the company and the elevation of this position to be a direct report to our president and chief executive officer. The committee believes that from an internal equity standpoint, these positions should carry the same salary grade. The vice president and CFO position remained in salary grade “I” for 2011 to maintain a one-step difference in salary grade level when compared to the president and chief executive officer positions at our business units and to reflect the separate treasurer position created in 2010. After reviewing the competitive analysis, the compensation committee made no changes in the base salary ranges associated with each named executive officer’s salary grade classification.

At its August 2010 meeting, the compensation committee reviewed Towers Watson’s assessment of internal equity between our chief executive officer, our chief financial officer, and the presidents and chief executive officers of our business units. The assessment showed that our chief executive officer’s 2010 pay as a multiple of the 2010 pay of our business units’ presidents and chief executive officers is generally consistent with the chief executive officer pay multiples of our performance graph peer group. Additionally, our chief executive officer’s 2010 pay as a multiple of our chief financial officer’s 2010 pay is higher than the chief executive officer pay multiple of our performance graph peer group due to our chief financial officer’s recent promotion to the position. The table below shows pay multiples for base salary, target annual cash, which is base salary plus target annual incentives, and total target direct compensation, which is the sum of target annual cash and the expected value of target long-term incentives.

| | | | | | 2018

| MDU Resources Group, Inc. Proxy Statement |

Internal Equity Assessment*compensation for the position changes significantly or the executive’s responsibilities and/or performance warrants a different salary grade. Individual executives may be paid below, equal to, or above the salary grade midpoint. Mr. Wells’ 2011 compensation was determined pursuant to his letter agreement in connection with his hiring effective May 2, 2011, and served as a basis for his 2012 compensation, rather than the business segment leaders’ salary grade.

| | | | | | | | | | | | | | | | | | | | 2010 CEO Pay Multiple for

MDU Resources Group, Inc.

| | CEO Pay Multiple of

Performance Graph Peer Group (1)

| | Title

| | Company or Business Unit

| | Base

Salary

| | Target

Annual

Cash

| | Total

Target Direct

Compensation

| | Base

Salary

| | Target

Annual

Cash

| | Total

Target Direct

Compensation

| | President & CEO

| | MDU Resources Group, Inc.

| | —

| | —

| | —

| | —

| | —

| | —

| | Vice President & CFO

| | MDU Resources Group, Inc.

| | 2.9x

| | 3.8x

| | 4.5x

| | 2.0x

| | 2.2x

| | 2.4x

| | President & CEO / 2nd Highest Paid

| | MDU Construction Services

| | | | | | | | | | | | | | | | Group, Inc.

| | 1.7x

| | 2.0x

| | 2.3x

| | 1.6x

| | 1.7x

| | 1.8x

| | President & CEO / 3rd Highest Paid

| | Knife River Corporation

| | 1.7x

| | 2.0x

| | 2.3x

| | 1.9x

| | 2.2x

| | 2.4x

| | President & CEO / 4th Highest Paid

| | WBI Holdings, Inc.

| | 2.1x

| | 2.6x

| | 2.9x

| | 2.2x

| | 2.4x

| | 3.0x

| | President & CEO / 5th Highest Paid

| | Combined Utility Group (2)

| | 2.3x

| | 2.8x

| | 3.2x

| | 2.4x

| | 3.1x

| | 4.1x

| |

| | (1)

| Performance graph peer group compensation data compiled by Towers Watson from most recent proxy statements as of July 2010.

| (2)

| Combined Utility Group consists of Montana-Dakota Utilities Co., Great Plains Natural Gas Co., Cascade Natural Gas Corporation, and Intermountain Gas Company

| *

| The information in the table is based solely upon information provided by Towers Watson and is not deemed filed or a part of this compensation discussion and analysis for certification purposes

|

The salary grades give the compensation committee determines where, relativeflexibility to the midpoint of eachassign different salaries to individual executives within a salary grade an individual’s base salary should be based onto reflect one or more of the following: | | • | executive’s performance on financial goals and on non-financial goals, including the results of the performance assessment program | | | • | executive’s experience, tenure, and future potential | | | • | position’s relative value compared to other positions within the company | | | • | relationship of the salary to the competitive salary market value | | | • | internal equity with other executives and | | | • | economic environment of the corporation or executive’s business unit.segment. |

No changes were made in the salary grade classifications of the named executive officers for 2012, and after reviewing the competitive analysis, the compensation committee made no changes in the base salary ranges associated with each named executive officer’s salary grade classification. Our named executive officers’ salary grade classifications for 2012 are listed below, along with the base salary ranges associated with each classification: | | | | | | | | | | | | | | | | | 2012 Base Salary (000s) | Position | | Grade | | Name | | Minimum

($) | | Midpoint

($) | | Maximum

($) | President and CEO | | K | | Terry D. Hildestad | | 620 | | 775 | | 930 | Vice President and CFO | | I | | Doran N. Schwartz | | 260 | | 325 | | 390 | President and CEO, WBI Holdings, Inc. | | J | | Steven L. Bietz | | 312 | | 390 | | 468 | President and CEO, Fidelity Exploration & Production Company | | J | | J. Kent Wells | | 312 | | 390 | | 468 | Executive Vice President – Bakken Development | | J | | William E. Schneider | | 312 | | 390 | | 468 |

| | Performance Assessment Program | Our performance assessment program rates performance of our executive officers, except for our chief executive officer, in the following areas, which help determine actual salaries within the range of salaries associated with the executive’s salary grade: |

| | | | • | visionary leadership | • | leadership | • | strategic thinking | • | mentoring | • | leading with integrity | • | relationship building | • | managing customer focus | • | conflict resolution | • | financial responsibility | • | organizational savvy | • | achievement focus | • | safety | • | judgment | • | Great Place to Work ®risk management

| • | planning and organization | | |

An executive’s overall performance in our performance assessment program is rated on a scale of one to five, with five as the highest rating denoting distinguished performance. An overall performance above 3.75 is considered commendable performance. The chief executive officer assessed each other named executive officer’s performance under the performance assessment program, and the compensation committee, as well as the full board of directors, assessed the chief executive officer’s performance. The board of directors rates our chief executive officer’s performance in the following areas:

| | | | •

| leadership

| •

| succession planning

| •

| integrity and values

| •

| human resources

| •

| strategic planning

| •

| external relations

| •

| financial results

| •

| board relations

| •

| communications

| | |

| | | | | | MDU Resources Group, Inc. Proxy Statement | 2119

|

The board of directors rates our chief executive officer’s performance in the following areas: | | | | • | leadership | • | succession planning | • | integrity and values | • | human resources | • | strategic planning | • | external relations | • | financial results | • | board relations | • | communications | • | risk management |

Our chief executive officer’s performance was rated on a scale of one to five, with five as the highest rating denoting performance well above expectations. Base Salaries of the Named Executive Officers for 2012 | Base Salaries of the Named Executive Officers for 2011Terry D. Hildestad

| In recognition ofThe compensation committee recommended a 6.67% salary increase for Mr. Hildestad for 2012, which would have raised his salary from $750,000 to $800,000 ($775,000 being the continued challengingmarket median). The compensation committee’s rationale for the increase was

|

| | • | his high performance evaluation | | | • | his high integrity, excellent business know how, and ability to work effectively with the management team and the board | | | • | his effectiveness in navigating the company through a difficult economic environment and our efforts to control costs, the compensation committee determined that, except for Mr. Schwartz, there would be no base | | | • | his salary increases for 2011. The compensation committee had alsobeen frozen 2010 base salaries at their 2009 levels for our named executive officers, except for Mr. Schwartz who received an increase in connection with his promotion to chief financial officer in 2010. Determination of Mr. Wells’ base salary is discussed below.since January 1, 2009. |

Mr. Hildestad, however, did not accept his base salary increase for 2012 in order to be treated the same as other Section 16 officers who did not receive a salary increase for 2012. | Doran N. Schwartz | Mr. Schwartz was elected vice president and chief financial officer effective February 17, 2010. For 20112012, the compensation committee awarded Mr. Schwartz a 5.0%9.9% increase, raising his 20102012 salary from $260,000$273,000 to $273,000.$300,000, or 92% of the midpoint of salary grade I for 2012. The compensation committee’s rationale for the increase was in recognition of: |

| | ���

| Mr. Schwartz’s commendable job in transitioning into his new position of chief financial officer in 2010

| | | • | his salary equaling the minimum of his salary grade

| | | •

| his leadership in helping reduce our 2011 corporate overhead expense budget by approximately $700,000 and

| | | •

| his assistance in the company achieving a return on invested capital of 7.5%6.9% for the twelve months ending June 20102011 as compared to the median return on invested capital of 6.4%6.0% for companies in our performance graph peer group over the same time period.period | | • | his success at building good working relationships with shareholders, rating agencies, and the financial community and | | • | moving his salary closer to the midpoint of salary grade I. |

| Steven L. Bietz | Mr. Bietz received no salary increase for 2012 because the compensation committee wanted to limit salary cost increases. | | J. Kent Wells | WhenMr. Wells received no salary increase for 2012 because he had just started his employment with the board initiatedcompany in May 2011 with a searchsalary above the maximum for a president and chief executive officer of Fidelity & Exploration Company, Mr. Hildestad directed the human resources department to conduct a competitive assessment to determine the remuneration necessary to recruit a qualified individual. The competitive assessment was done in January 2011. Using information collected from most recent public company proxy statements by Equilar, Inc., an independent data collection firm, the human resources department’s analysis looked at 2009 compensation data for chief executive officer positions at companies in the following Standard Industrial Classification (SIC) codes:his salary grade.

| | | •

| 1311 – Crude Petroleum and Natural GasWilliam E. Schneider

| | | •

| 1321 – Natural Gas Liquids

| | | •

| 1381 – Drilling OilMr. Schneider received no salary increase for 2012 because his salary was 115% of the market value for his position and Gas Wells and

| | | •

| 1382 – Oil and Gas Field Exploration Services.the compensation committee wanted to limit salary cost increases.

|

Revenue ranged from $250 million to $850 million with median revenue of $591 million at the 36 companies surveyed. These companies are listed on Exhibit C.

The competitive assessment measured base salary, target annual cash compensation, which was base salary plus annual discretionary bonus plus target annual non-equity incentive plan compensation, and target total direct compensation, which was target annual cash compensation plus the target value of long term incentives plus the change in pension and non-qualified deferred compensation plus all other compensation as reported in a company’s proxy statement. The results of the competitive analysis were:

| | | | | Compensation Item | | | CEO Data | | Base Salary (median) | | $ | 559,961 | | Target Annual Cash Compensation (median) | | $ | 1,050,000 | | Target Total Direct Compensation (median) | | $ | 2,337,003 | |

Mr. Wells’ base salary of $550,000 approximated the median base salary of $559,961 paid to chief executive officers in the competitive assessment. We determined that Mr. Wells’ base salary should be close to the median paid to chief executive officers and above the maximum for his salary grade level because we determined that level was necessary to recruit Mr. Wells for this position.

| | | | | | 2220

| MDU Resources Group, Inc. Proxy Statement |

The following table shows each named executive officer’s base salary for 2010 and 2011 and the percentage change:

| | | | | | | | | | | Name | | Base Salary

for 2010

(000s)

($) | | Base Salary

for 2011

(000s)

($) | | % Change

(%) | | Terry D. Hildestad | | | 750.0 | | | 750.0 | | | 0.0 | | Doran N. Schwartz (1) | | | 260.0 | | | 273.0 | | | 5.0 | | J. Kent Wells (2) | | | n/a | | | 550.0 | | | n/a | | John G. Harp | | | 450.0 | | | 450.0 | | | 0.0 | | William E. Schneider | | | 447.4 | | | 447.4 | | | 0.0 | |

| | (1)

| Elected vice president and chief financial officer effective February 17, 2010. Salary shown is not prorated.

| (2)

| Hired May 2, 2011, as president and chief executive officer of Fidelity Exploration & Production Company. Salary shown is not prorated.

|

20112012 Annual Incentives

What the Performance Measures Are and Why We Chose Them The compensation committee develops and reviews financial and other corporate performance measures to help ensure that compensation to the executives reflects the success of their respective business unitsegment and/or the corporation, as well as the value provided to our stockholders. For all business segment chief executive officers, including Messrs. Wells, Harp,Wells and Schneider,Bietz, the performance measures for annual incentive awards are their respective business unit’s annual return on invested capital results compared to target and their respective business unit’s | | • | their respective business segment’s annual return on invested capital results compared to target | | | • | their respective business segment’s allocated earnings per share results compared to target and | | | • | the company’s consolidated earnings per share compared to a target of $1.19. |

The compensation committee added the third performance measure, consolidated earnings per share, results compared to target, with Mr. Wells’ 2011 annual incentivefor the first time in 2012. The compensation committee weighted the 2012 performance measures for Messrs. Wells and Bietz at 75% for Fidelity Exploration & Production Companytheir business segment performance measures (weighted evenly) and 25% for WBI Holdings, Inc. For the named executive officers working at MDU Resources Group, Inc. in 2011,2012, who were Messrs. Hildestad, Schwartz, and Schwartz,Schneider, the compensation committee based 20112012 annual incentives on the weighted averageachievement of performance goals at the incentive payments made tobusiness segments: (i) the chief executive officers of MDU Construction Services Group, Inc., Knife River Corporation, WBI Holdings, Inc.,construction materials and contracting and construction services segments, (ii) the Combined Utility Group, which consists of Montana-Dakota Utilities Co., Great Plains Natural Gas Co., Cascade Natural Gas Corporation,pipeline and Intermountain Gas Company.energy services segment, (iii) the exploration and production segment, and (iv) the electric and natural gas distribution segments. The compensation committee’s rationale for this approach was to provide greater alignment between the MDU Resources Group, Inc. executives and the business unit executives’ annual incentive payments andsegment performance. This methodology requires that all business unit executives receive a maximum annual incentive payment before the MDU Resources Group, Inc. executives receive a maximum annual incentive payment. The compensation committee believes earnings per share and return on invested capital are very good measurements in assessing a business unit’ssegment’s performance and the company’s performance from a financial standpoint.perspective. Earnings per share is a generally accepted accounting principle measurement and is a key driver of stockholder return over the long-term. Return on invested capital measures howmeasure show efficiently and effectively management deploys capital. Sustained returns on invested capital in excess of a business unit’ssegment’s cost of capital create value for our stockholders. Allocated earnings per share for a business unitsegment is calculated by dividing that business unit’ssegment’s earnings by the business unit’ssegment’s portion of the total company weighted average shares outstanding. Return on invested capital for a business unitsegment is calculated by dividing the business unit’ssegment’s earnings, without regard to after tax interest expense and preferred stock dividends, by the business unit’ssegment’s average capitalization for the calendar year. The compensation committee determines the weighting of the performance measures each year based upon recommendations from the chief executive officer. The compensation committee maintained the 2011 performance measure weightings at 50% each because the compensation committee believes both measures are equally important in driving stockholder value in the short term and long term.

We establish our incentive plan performance targets in connection with our annual financial planning process, where we assess the economic environment, competitive outlook, industry trends, and company specific conditions to set projections of results. The compensation committee evaluates the projected results and uses this evaluation to establish the incentive plan performance targets based upon recommendation of the chief executive officer. The compensation committee also considers annual change inIn determining where to set the return on invested capital measure in establishing targets to help ensure that return on invested capital will equal or exceedtarget, the compensation committee considers the business segment’s weighted average cost of capital over time.capital. The weighted average cost of capital is a composite cost of the individual sources of funds including equity and debt used to finance a company’s assets. It is calculated by averaging the cost of debt plus the cost of equity by the proportion each represents in our, or the business segment’s, capital structure. For 2011,2012, the compensation committee chose to use the return on invested capital target for each business segment as approved by | | | | | MDU Resources Group, Inc. Proxy Statement

| 23

|

the board in the 20112012 business plan. Furthermore,plan, except for the construction services segment, which had a target higher than the 2012 business plan to incentivize efforts for that segment to achieve its weighted average cost of capital within five years. The compensation committee continued its 2010 practice and imposed an additional requirement for the 20112012 return on invested capital portion of the annual incentives except for the Combined Utility Group. Results aboveconstruction materials and contracting segment, the 2011 return on invested capital target would not generateconstruction services segment, and the exploration and production segment. The additional annual incentive compensation forrequirement was the business unit executives, unless 2011 return on invested capital results met or exceeded a business unit’ssegment needed to achieve its weighted average cost of capital. In that case, the business unit chief executive officer could earncapital in order to achieve 200% of the annual incentive target attributable to the return on invested capital portion of the annual incentive. However, payments with respect to 2012 return on invested capital results above the 2012 target but below the weighted average cost of capital would be interpolated, in order to motivate these executives to achieve performance levels between the return on invested capital performance targets and the weighted average cost of capital for their respective business segments. | | | MDU Resources Group, Inc.Proxy Statement | 21 |